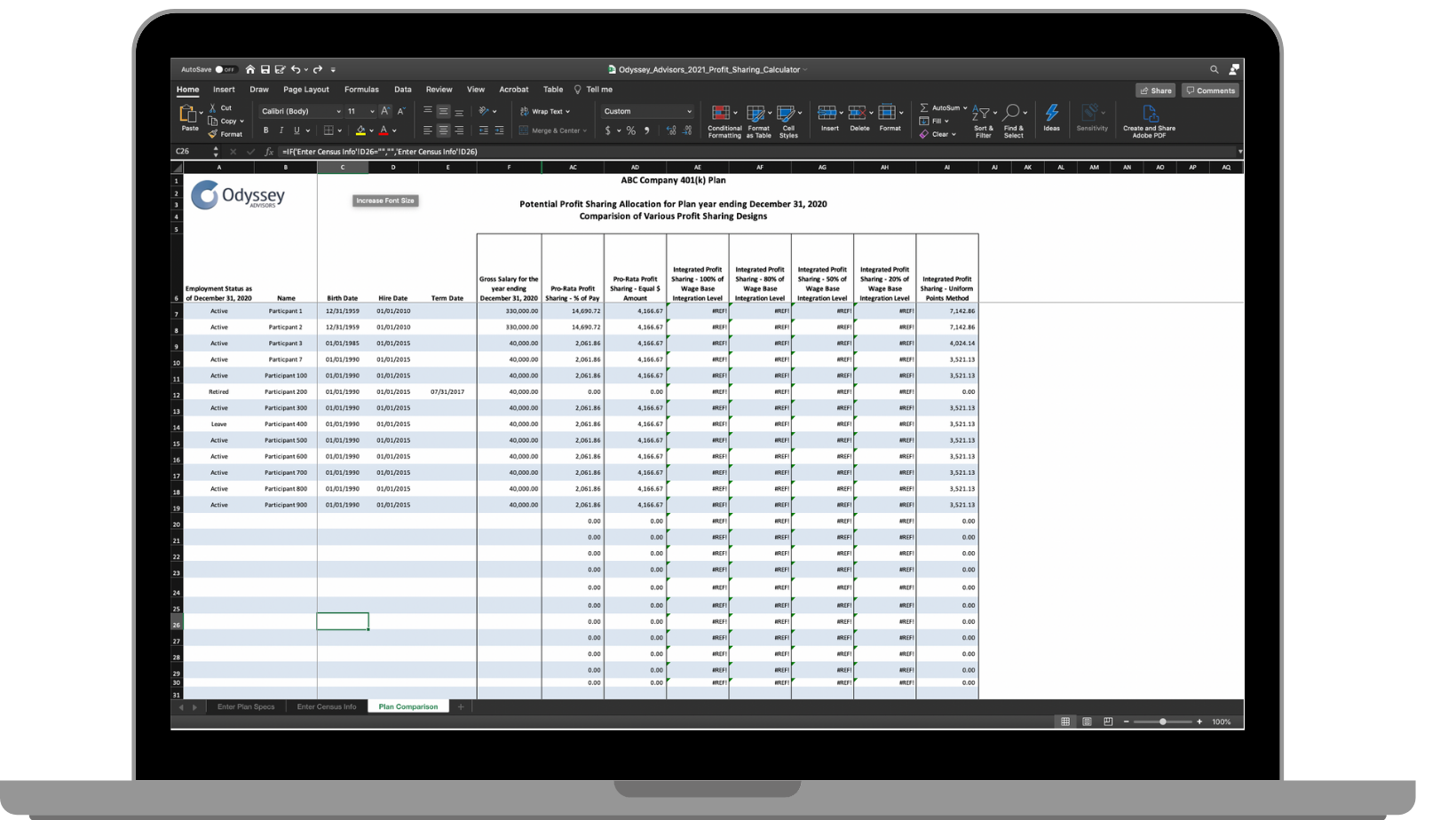

Types of Profit Sharing Plans

Not all Profit Sharing Plans are created equal. You could provide the same percentage of pay to all employees, the same dollar amount, steer funds to key employees, or provide a higher percentage of pay to higher-income employees, but the options don't end there.

Pro-Rata

This is the most common Profit Sharing Plan formula. Basically with this formula, you would choose to provide the same percentage of pay or the same dollar amount to all eligible employees.

Permitted Disparity or Integrated

As FICA taxes are only applied on income up to the Social Security Wage Base each year ($142,800 for 2021), many employers choose to provide an extra contribution for income above a percentage of that threshold. This may be valuable for higher-income business owners who are of similar age as their employees.

Uniform Points Allocation

The most common method is to allocate "points" based on age & service. For example, a 50-year employee with 20 years of service would receive 50+20 points for a total of 70 points. The total profit sharing contribution would be allocated to each participant based on their share of the total points.

Age-Weighted Allocation

This option allows for higher contributions for older employees who are closer to retirement age. This design is best suited for groups with a smaller percentage of older employees.

This method requires actuarial calculations to ensure it meets discrimination requirements.

New Comparability (Employee Group)

This option would allow you to designate employees into different groups (often by job classification) and then, you would choose a contribution rate for each group - normally steering a much higher percentage of the contributions to owners or key staff.

Please note: this method requires nondiscrimination testing to ensure that benefits do not overly favor highly compensated employees.